what is a secondary property tax levy

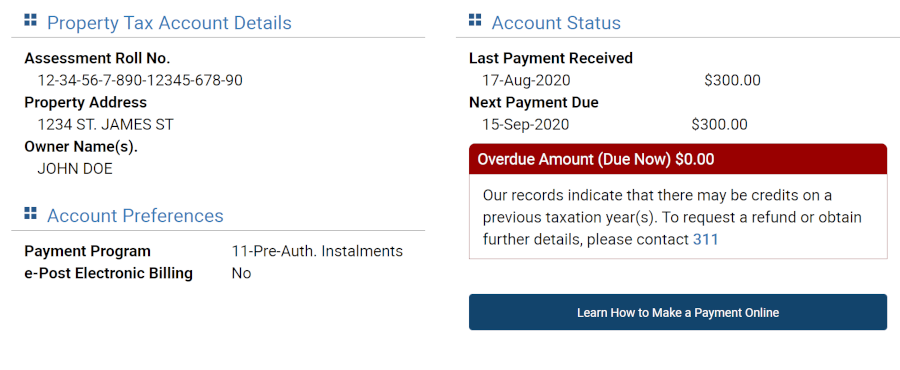

Governments enforce a property tax levy as a measure of last resort. Search the history of tax payments for your property.

To learn more about liens see Understanding a Federal Tax Lien.

. As more than one school district may be located in a tax collecting unit and a school district may not encompass the whole taxing unit for those parcels where school district taxes are being levied in the summer the 250 retaining fee may not be applied but the 250 retaining fee may be applied to the other parcels in the taxing unit. Secondary property taxes 1 Current years levy 1666442 2 Prior years levies 29660 3 Total secondary property taxes 1696102 C. See if you Qualify for IRS Fresh Start Request Online.

1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. A levy is a legal seizure of your property to satisfy a tax debt. A property tax levy is the right to seize an asset as a substitute for non-payment.

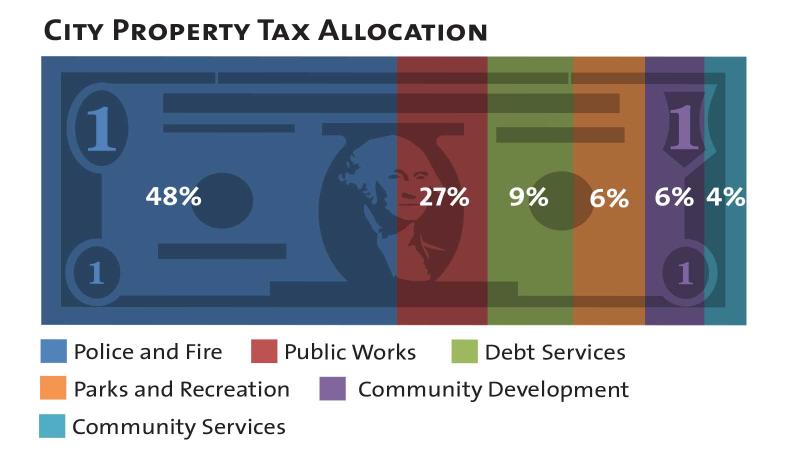

To help inform the discussion here are some answers to frequently asked questions. The City uses the tax levy not the tax rate to manage the secondary property tax. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. Calculate your real estate tax by multiplying your propertys assessed value by the annual tax rate. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt.

Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report. COMPARISON OF FY 202223 AND FY 202122 SECONDARY TAX RATES. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation. The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. In other words the levy is the cap on the amount of property tax dollars a local government is allowed by law to collect.

Search the history of tax bills for your property. A levy is a legal seizure of your property to satisfy a tax debt. A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them.

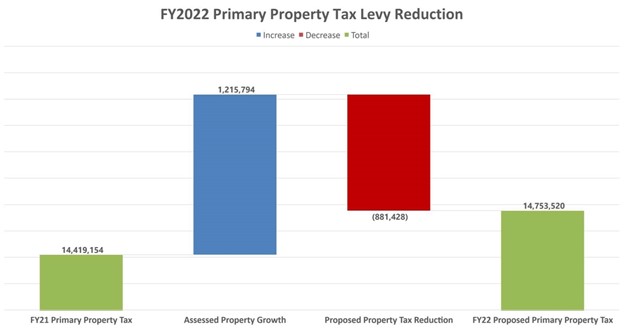

Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

This involves collecting assets and seizure of your property either tangible or intangible in a variety of ways. Secondary Property Tax SEC. Prior to 2019 CCC also levied a secondary property tax which was not renewed by voters.

Paul Mayor Melvin Carter is proposing a 15 percent hike in the citys property tax levy in his 2023 budget. An IRS levy permits the legal seizure of your property to satisfy a tax debt. If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing contact us right away.

Ad See If You Qualify For IRS Fresh Start Program. Ad Vast Library of Fillable Legal Documents. PIMA COUNTY FISCAL YEAR 202223 TAX LEVY.

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. County Community College Cent. The Arizona Constitution limits the total amount of primary property taxes that counties cities and community college districts can levy.

Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. Prior to 2019 CCC also levied a secondary property tax which was not renewed by voters. About half that jump comes.

Best Tool to Create Edit Share PDFs. Therefore not paying your property taxes can result in the government seizing your property as payment. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

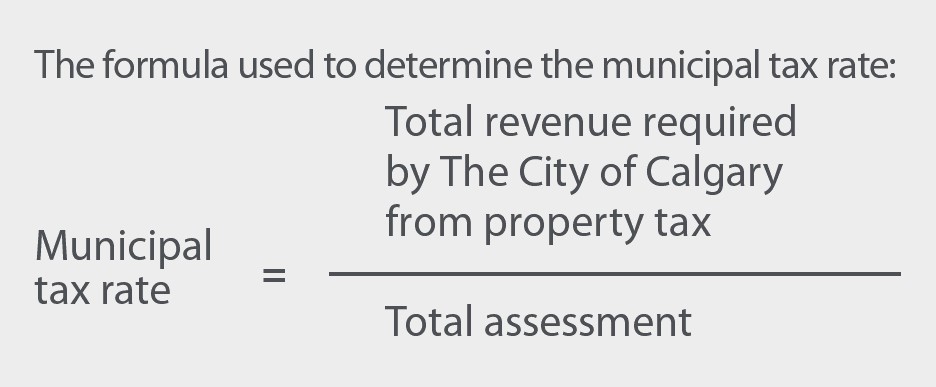

The tax levy is calculated using the formula to the right. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. Levies are different from liens.

Arizona Property Tax and School Equalization Tax are not levied for FY 202223. Levy Limits Homeowners Rebate Tax Deferral Exemptions. Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding.

Where does Internal Revenue Service IRS authority to levy originate. Secondary property taxes are levied to pay principal and interest on bonded indebtedness. Columbus City Schools will need to pass a property tax levy in November 2024 to fund teachers union salary increases no matter how negotiations shake out school board members told The.

A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of. Free Case Review Begin Online. A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt.

Reduce property taxes for yourself or residential commercial businesses for commissions. Secondary Property Tax Levy debt repayment. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle.

The idea of a levy is that the government will take the property because you are unable. Towns and cities use the proceeds from levying property taxes to fund the. Refer to number 4.

Based On Circumstances You May Already Qualify For Tax Relief. How do you calculate real estate tax. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services.

An IRS levy is not a public record and should not affect your credit report. Flagstaff Unified School District 1. SD1 Flagstaff - primary tax levy for FUSD.

For more information on FUSDs 2019 property tax rates click here. The levy which would total 2023 million for 2023 would amount to a 231 property tax increase for the owner of a median-value home which is 261800 according to Ramsey County. A levy is a legal seizure of your property to satisfy a tax debt.

Search the tax Codes and Rates for your area. For additional questions on tax rates and CCCs budget please contact CCC at 928 527-1222. Visit the Treasurers home page to view important announcements and tax bill information.

14 Special District Tax.

City Budget 2022 Be Heard New West City

City Of Cranbrook Council Adopts Budget Monday Night Endorsing 2 75 Property Tax Increase

Four Budget Visuals That Help You Tell Your Story Muniserv

Brampton Property Taxes Going Up 1 5 Per Cent After Council Passes 2022 Budget The Star

Council Approves 2022 Tax Levy City Of Bloomington Mn

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Property Tax Rate To Decrease For 2nd Straight Year Inmaricopa

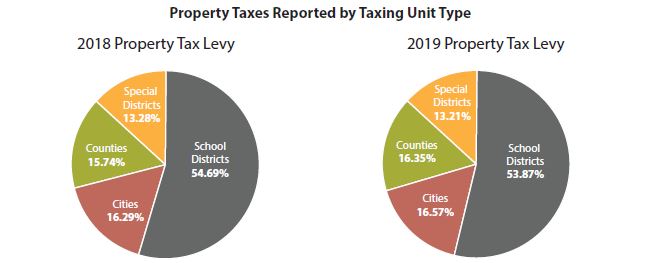

Local Property Tax Levies Texas County Progress

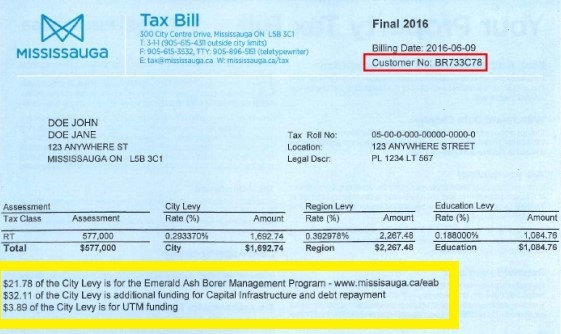

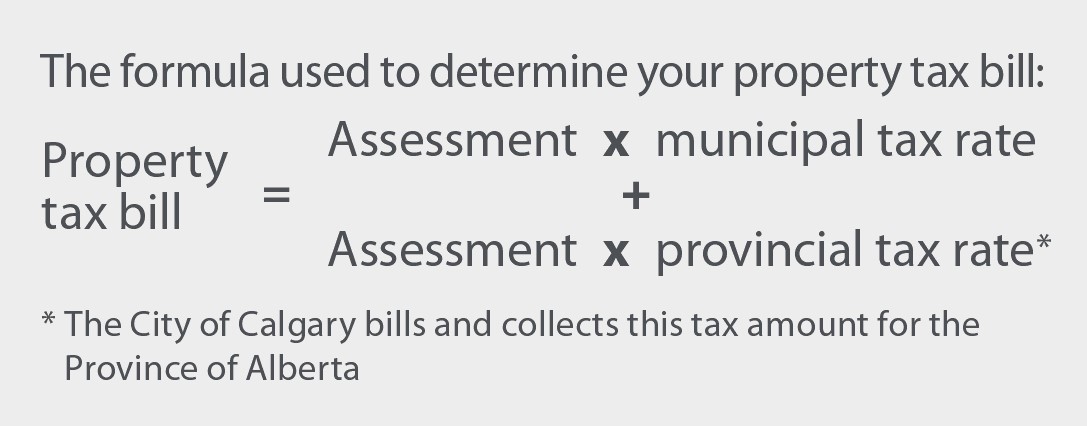

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Ontario Property Tax Rates Calculator Wowa Ca